The Tale of Two Tels

"Jay, I would like to buy a vowel please."

Late Thursday afternoon, April 26, 2007 Mitel announced its acquisition of Inter-Tel (NASDAQ: INTL) for $723 million. You might recall that Mitel, the storied Canadian PBX innovator has been planning an IPO for several years now as it restructures its channels, product lines and focus on IP communications.

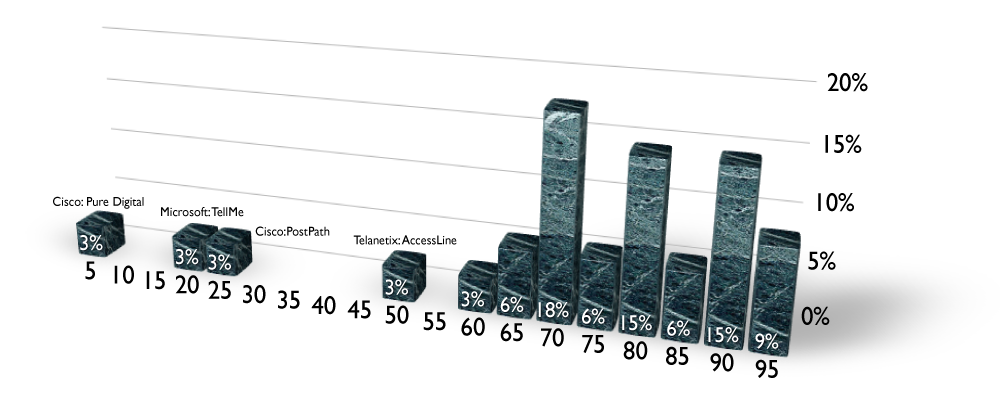

This is a major step towards the rollup that the enterprise communications market desperately needs. There are just too many vendors chasing too-few resellers to sell to too-few customers. Functionality is moving away from the classic proprietary handset-to-hardware into wide open competition among devices, servers and applications. Prices are expected to accelerate downwards as Microsoft and IBM gain momentum in product functionality – it's time to bulk up folks – and get your new technologies in the deal-flows that incumbents always get to participate in.

Like Larry Ellison explained to his board in 2004 to kick off the PeopleSoft acquisition process and the rollup in enterprise software – buying competitors and getting a buy into their purchasing cycles is cheaper than fighting to rip out whatever that customer bought. No doubt IBM Software division figured this out too.

Here's my scoring of the deal:

Strategic fit [5/5].

This is a deal for scale and channel. Products do overlap, although industry focus doesn't. Probably most important to Mitel, this provides an appropriate short-circuit of the pressure to go IPO. No doubt for a company that gone public once before, then was acquired by British Telecom where it's strengths were wasted, then spun out, then re-acquired by Sir Terrance Matthews (one of the founders) and taken private to be refitted and restructured. The anticipation in Ottawa (the HQ) for IPO, and the constant postponement was weighing pretty heavy on the leadership (my view). This intermediate step of bulking up with Inter-Tel, which they're planning to take private and then re-enter the public markets at another time gives Mitel leadership time and a reason to postpone the risk of a disappointing IPO.

Now, Shoretel (now in process of IPO'ing) has to make some tough calls.

Timing [5/5].

Excellent timing. This will spark other deals, and gives Mitel some much needed first mover advantage.

Customer demand [3/5].

There will be some consolidation in the channel support organization at these two companies in the coming year, and consolidation around the two-tier model improving financing and inventory control. A Google search on 'Mitel Inter-Tel' gives 186,000 references where the top 10 references are resellers for both brands. Generally, Inter-Tel gets 1/2 its revenues from channel, and the other half from its national direct sales organization. Mitel is virtually all channel. These organizations don't really compete for the same customer and the same channel. No doubt the combined company will introduce special channel loyalty programs to strengthen its relationship with the dual product channel, and expand the other products into channels committed to only one brand.

Potential [5/5].

I am bullish on this deal. Years ago, product lines were expensive to maintain and operate. Today, they are a tiny fraction of the whole cost and process. Now, it's the channel support and access to the market that is the expensive and critical piece of the equation. Rationalizing products is not a source of big savings. I don't expect any product line rationalization to take place soon. Sharing of technologies, re-prioritizing R&D projects, pooling centers of excellent – you bet!

Inter-Tel has a strong direct sales organization in the United States. Mitel has a strong channel organization in the US, but is quite strong in the UK and in the hospitality market. Both companies are players in the mid-market.

Now that Mitel has purchased a vowel, will the next one begin with a 'T' and then a 'E'?

Letter grade = A (80%).