Beyond ETFs – is a software product and subscription service designed for providing the knowledge and discipline to manage one’s own Self-Directed Fund.

Over the past fifty years we seen the evolution of two important investment ‘Funds.’

We’ve witnessed the rapid growth and decline of Mutual Funds– baskets of securities that act a lot like individual securities. Mutual Funds have been managed by ‘rock star’ professional managers who personally decide what positions to buy and when to sell. Mutual Funds are organized typically around investing styles such as growth, value, social, ethical and market cap size, typically encompassing small, medium, large cap companies.

Subscribers pay up-front, or back-end administration fees to participate or for having participated. Also, a cut of the success of the fund is paid to the managers. Mutual funds are regulated by the Securities and Exchange Commission which strictly controls the formation, documentation, marketing and operation of the fund.

The success of Mutual Funds have largely been overtaken by the rise of Exchange-Traded Funds (ETFs),which are baskets of securities managed according to simple rules such as matching the composition and price of a market Index or industry sector. ETFs typically have much lower management fees because the overhead of expensive analysts and fund managers is eliminated, and the manager resets the composition of the fund every day to maintain conformity with their tracking goals. For example, an ETF tracking the S&P 100 index, would have to own the 100 companies of the S&P 100 index regardless of net cash inflows or outflows.

For ETF managers, it’s an issue of balancing purchases and sales to deliver on the imitation of the Index. ETFs are also tightly regulated by the Securities Exchange Commission which controls their formation , marketing and sale.

So, what is ‘Beyond ETFs?’

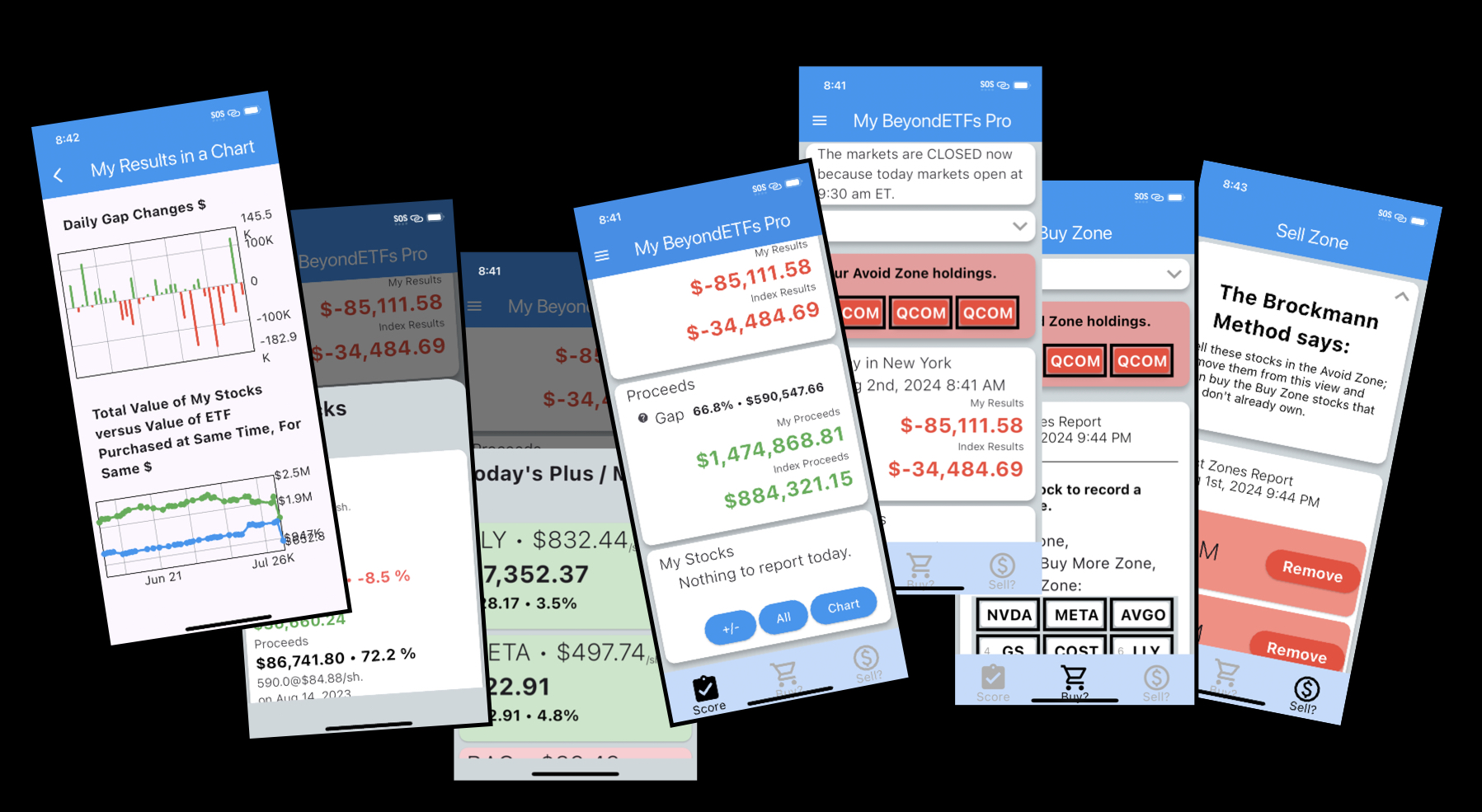

Beyond ETFs is all about enabling the Self-Directed Fund (SDF). SDF is the basket of securities, bought and sold and managed by yourself, to achieve your financial goals. Like any Mutual Fund or ETF, the SDF must embody a coherent and focused strategy. I mean, it does if you want it be an effective, that is to say, a high-performing SDF. The SDF is not regulated by the SEC, per se, but the underlying assets of a SDF certainly are.

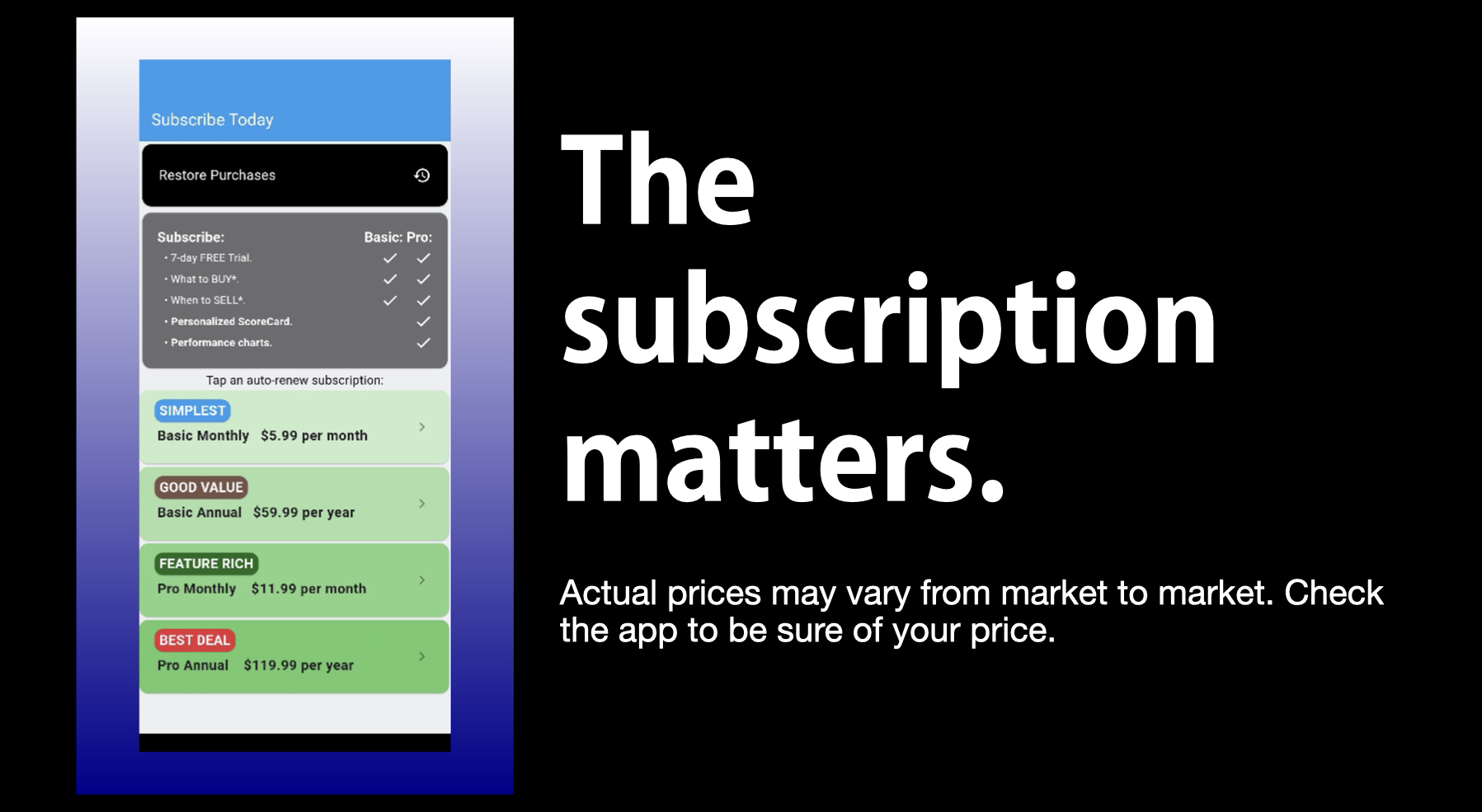

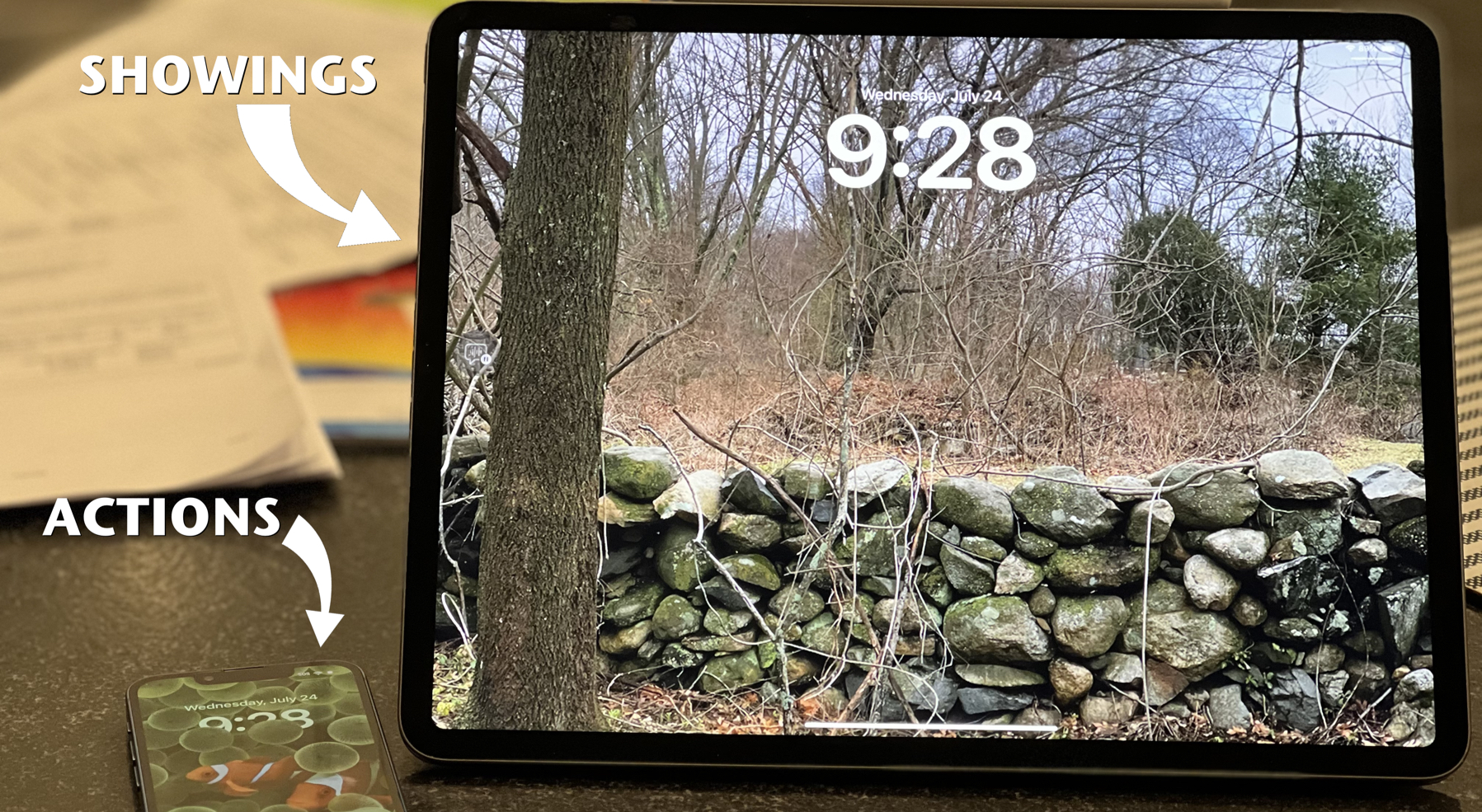

Beyond ETFs by Brockmann & Company is an SDF information management tool to help manage one’s own SDF. Subscribers get exclusive access to The Brockmann Method and their own personalized scorecard. They are also able to use the app to learn the two most important bits of information about investing for the SDF that they need to have: what to buy and when to sell.